Disclosure Based on TCFD

Recommendations

Disclosure Based on TCFD

Recommendations

Response to TCFD

In May 2019, the Panasonic Group endorsed the TCFD*1 recommendations. Recognizing that risks and opportunities related to climate change are critical management issues, the Panasonic Group is identifying risks and opportunities based on the recommendations and examining the resilience of its strategies through scenario analysis.

Based on the above recognition and verification results, Panasonic Energy will deepen its consideration of risks and opportunities specific to our business and proactively disclose the required information. As recommended by the TCFD, we will disclose information on ‘governance’, ‘strategy’, ‘risk management’, and ‘indices and targets’ to strengthen our dialogue with our stakeholders.

*1 TCFD: an abbreviation of Task Force on Climate-related Financial Disclosures. The task force was set up by the Financial Stability Board (FSB) in response to a request by the G20 Finance Ministers and Central Bank Governors. TCFD published its recommendations in 2017.

Response to TCFD

In May 2019, the Panasonic Group endorsed the TCFD*1 recommendations. Recognizing that risks and opportunities related to climate change are critical management issues, the Panasonic Group is identifying risks and opportunities based on the recommendations and examining the resilience of its strategies through scenario analysis.

Based on the above recognition and verification results, Panasonic Energy will deepen its consideration of risks and opportunities specific to our business and proactively disclose the required information. As recommended by the TCFD, we will disclose information on ‘governance’, ‘strategy’, ‘risk management’, and ‘indices and targets’ to strengthen our dialogue with our stakeholders.

*1 TCFD: an abbreviation of Task Force on Climate-related Financial Disclosures. The task force was set up by the Financial Stability Board (FSB) in response to a request by the G20 Finance Ministers and Central Bank Governors. TCFD published its recommendations in 2017.

Governance

At Panasonic Energy, the Board of Directors oversees risks and opportunities related to climate change based on reports and recommendations from the ESG Committee at least once a year.

Chaired by the president, the Committee includes all executive officers responsible for divisions related to climate change, such as business divisions, human resources, and legal affairs, as well as divisions in charge of the environment. The Committee formulates overall plans, monitors progress, and evaluates the status of achievement in a cross-organizational framework.

The Committee formulates overall plans, monitors progress, and evaluates the status of achievement in a cross-organizational framework.

In parallel, we analyze risks and opportunities related to climate change and, based on the results, confirm the relevance of our business strategy from a resilience perspective.

In addition, to strengthen the commitment of our executive officers, performance-based remuneration (which is an incentive linked to short term and mid-long term business results) is structured to reflect climate change-related results as well as financial indicators.

Governance

At Panasonic Energy, the Board of Directors oversees risks and opportunities related to climate change based on reports and recommendations from the ESG Committee at least once a year.

Chaired by the president, the Committee includes all executive officers responsible for divisions related to climate change, such as business divisions, human resources, and legal affairs, as well as divisions in charge of the environment. The Committee formulates overall plans, monitors progress, and evaluates the status of achievement in a cross-organizational framework.

The Committee formulates overall plans, monitors progress, and evaluates the status of achievement in a cross-organizational framework.

In parallel, we analyze risks and opportunities related to climate change and, based on the results, confirm the relevance of our business strategy from a resilience perspective.

In addition, to strengthen the commitment of our executive officers, performance-based remuneration (which is an incentive linked to short term and mid-long term business results) is structured to reflect climate change-related results as well as financial indicators.

Strategy

To society transition to a low-carbon economy, we have set the following targets.

■

FY2029: Net Zero factories*2 All sites

■

FY2031: Create approx. 45 million tons of avoided CO2 emissions

To establish the above goals and verify the resilience of our strategy, we have conducted a scenario analysis in line with the framework of the TCFD recommendations.

The scenario analysis was conducted as follows, targeting the Mobility Energy Business and part of the Energy Solution Business, which account for a large proportion of our financial performance and contribute significantly to avoided CO2 emissions.

■

Assumed timeframe: FY2031 and FY2051

■

Adopted scenarios: Risks and opportunities were identified based on a set of scenarios (including the 1.5℃ scenario and the 4℃ scenario), which were adopted in the Panasonic Group scenario analysis. For more details, please refer to the four scenarios in the Panasonic Group entitled “Environment: Strategy Resilience through Scenario Analysis.”

*2 Factories that have achieved virtually zero CO2 emissions by conserving energy, introducing renewable energy, and using credits.

Strategy

To society transition to a low-carbon economy, we have set the following targets.

■

FY2029: Net Zero factories*2 All sites

■

FY2031: Create approx. 45 million tons of avoided CO2 emissions

To establish the above goals and verify the resilience of our strategy, we have conducted a scenario analysis in line with the framework of the TCFD recommendations.

The scenario analysis was conducted as follows, targeting the Mobility Energy Business and part of the Energy Solution Business, which account for a large proportion of our financial performance and contribute significantly to avoided CO2 emissions.

■

Assumed timeframe: FY2031 and FY2051

■

Adopted scenarios: Risks and opportunities were identified based on a set of scenarios (including the 1.5℃ scenario and the 4℃ scenario), which were adopted in the Panasonic Group scenario analysis. For more details, please refer to the four scenarios in the Panasonic Group entitled “Environment: Strategy Resilience through Scenario Analysis.”

*2 Factories that have achieved virtually zero CO2 emissions by conserving energy, introducing renewable energy, and using credits.

Risk Management

Panasonic Energy has established an Enterprise Risk Management Committee (“ERM Committee”) to manage various risks, including those related to climate change, in an integrated manner.

Based on the PDCA cycle of risk management, the ERM Committee reports regularly to the Management Meeting and the Board of Directors on essential risks and the progress of countermeasures. Each year, the Committee identifies risk items in terms of “impact” and “possibility of occurrence” while also defining “operational risk” as events that have the potential to affect business activities and pose an operational threat. In fiscal 2025, we again identified earthquakes and tsunamis as operational risks and managed progress on measures to deal with flooding and other disasters.

Regarding the transitional risks, such as an increase in the cost of compliance with environmental regulations, the relevant departments closely monitor trends and take appropriate measures while the Management Meeting continues to manage the progress. In compliance with the EU Battery Regulations in particular, we thoroughly manage risks to our business activities by managing the progress of measures and raising issues at quarterly meetings that include the relevant departments and management.

Risk Management

Panasonic Energy has established an Enterprise Risk Management Committee (“ERM Committee”) to manage various risks, including those related to climate change, in an integrated manner.

Based on the PDCA cycle of risk management, the ERM Committee reports regularly to the Management Meeting and the Board of Directors on essential risks and the progress of countermeasures. Each year, the Committee identifies risk items in terms of “impact” and “possibility of occurrence” while also defining “operational risk” as events that have the potential to affect business activities and pose an operational threat. In fiscal 2025, we again identified earthquakes and tsunamis as operational risks and managed progress on measures to deal with flooding and other disasters.

Regarding the transitional risks, such as an increase in the cost of compliance with environmental regulations, the relevant departments closely monitor trends and take appropriate measures while the Management Meeting continues to manage the progress. In compliance with the EU Battery Regulations in particular, we thoroughly manage risks to our business activities by managing the progress of measures and raising issues at quarterly meetings that include the relevant departments and management.

Metrics and Targets

In addition to disclosing actual GHG emissions (Scope 1, 2, 3), we have set a goal of achieving all of Net Zero Factories* by fiscal 2029 and are working hard to reduce emissions.

We have also set targets for GHG emissions outside of our own company, including the avoided CO2 emissions that we contribute to society and the reduction of the carbon footprint of our products, including those upstream in our supply chain.

Furthermore, we have established our own “Environmental Contribution Index” (an index that indicates the ratio of avoided CO2 emissions to the actual CO2 emissions from our battery production), which is a composite of the above indicators. We are working to improve this to 10 in fiscal 2031. For more details of our efforts to set and achieve our goals, please refer to the Environmental page of the sustainability website.

Metrics and Targets

In addition to disclosing actual GHG emissions (Scope 1, 2, 3), we have set a goal of achieving all of Net Zero Factories* by fiscal 2029 and are working hard to reduce emissions.

We have also set targets for GHG emissions outside of our own company, including the avoided CO2 emissions that we contribute to society and the reduction of the carbon footprint of our products, including those upstream in our supply chain.

Furthermore, we have established our own “Environmental Contribution Index” (an index that indicates the ratio of avoided CO2 emissions to the actual CO2 emissions from our battery production), which is a composite of the above indicators. We are working to improve this to 10 in fiscal 2031. For more details of our efforts to set and achieve our goals, please refer to the Environmental page of the sustainability website.

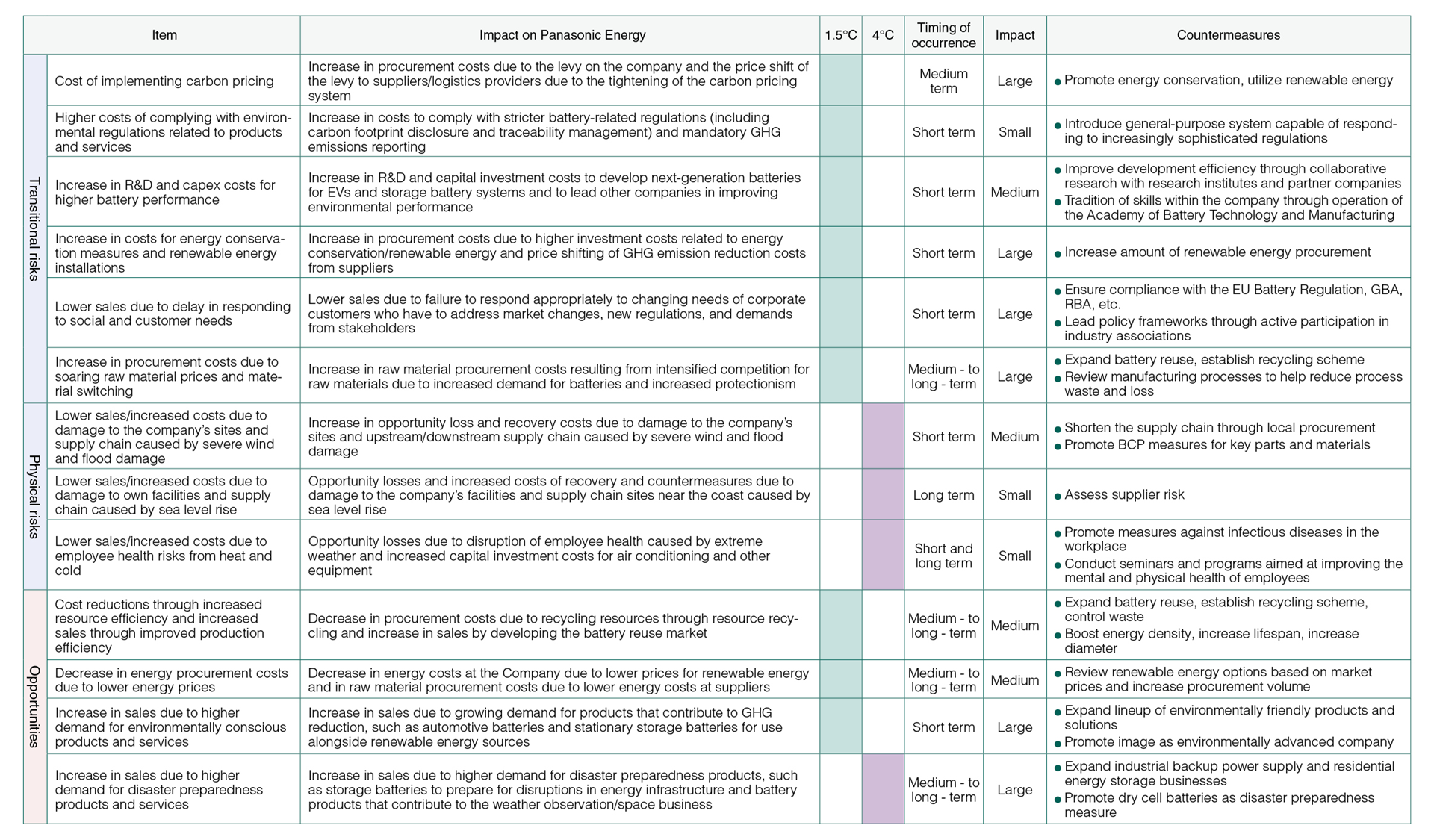

Significant risks and opportunities and how to respond

The items identified as significant climate-related risks and opportunities are shown in the table below. For each item, the table shows the main applicable scenarios, the timing of occurrence, the impact, and our countermeasures. We prioritize our responses to these items based on the timing of their occurrence and their degree of impact.

Significant risks and opportunities and how to respond

The items identified as significant climate-related risks and opportunities are shown in the table below. For each item, the table shows the main applicable scenarios, the timing of occurrence, the impact, and our countermeasures. We prioritize our responses to these items based on the timing of their occurrence and their degree of impact.